WALT (Weighted Average Lease Term) is an important metric in commercial real estate that indicates how much contract rent remains at a property. It measures the average time left on all leases, factoring in the rent each tenant pays. Rental income is typically used as the weight in the calculation. WALT is frequently applied in analyzing various property types, such as office buildings, retail spaces, and industrial properties.

How to Calculate WALT Using DAX

Here’s a step-by-step guide for calculating WALT using DAX in Power BI:

Add a Calculated Column for the Remaining Lease Term

Add a new calculated column to your rent roll table that calculates the remaining term on a lease, expressed in partial years:

RemainingLeaseTerm =

DATEDIFF(TODAY(), FactRentRollCommercial[LeaseToDate], YEAR) +

(

DATEDIFF(

TODAY(),

FactRentRollCommercial[LeaseToDate],

DAY

) – DATEDIFF(TODAY(), FactRentRollCommercial[LeaseToDate], YEAR) * 365

) / 36

Add a Calculated Column for the Weighted Term

Next, create a new calculated column that multiplies the remaining lease term by the rent to determine the weighted term:

WeightedTerm = FactRentRollCommercial[RemainingLeaseTerm] * FactRentRollCommercial[Rent]

Create a Measure for the Total Weighted Term

Use a measure to sum up all the weighted terms:

TotalWeightedTerm = SUM(FactRentRollCommercial[WeightedTerm])

Create a Measure for Total Rent Income

Create another measure that sums up all the rent:

TotalRentIncome = SUM(FactRentRollCommercial[Rent])

Calculate WALT

Finally, use the total weighted term and total rent income to calculate WALT:

WALT =

DIVIDE(

[TotalWeightedTerm],

[TotalRentIncome]

)

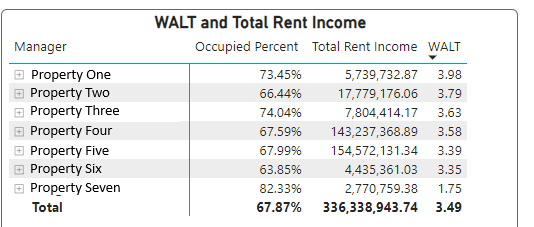

With your new measure, you can now insert and roll up your WALT in Power BI using a simple Tablix.